Fringe Benefits & Employee Auto Pays

Payroll Earnings are amounts added to an employee's paycheck, typically reflecting compensation for work performed during a specific pay period. In Empeon Workforce, any earning that needs to be applied toward an employee's paycheck, first needs to be set up as a Earning Code within the system. Then once the Earning Code is established, it can be applied manually within Pay Entry as needed, or assigned to the Employee Profile with a recurring schedule.

In Empeon Workforce, there are two tools within the Employee Profile that allow a Workforce User to set up a recurring schedule for specific Earning Codes:

- Fringe Benefits - This is the more common option. It allows the earning to be set up on a recurring schedule and is applied in the payroll batch only when other earnings, typically the employee's Regular earnings, are entered on the check. With the Fringe Benefit tool, you can also establish Third-Party Agencies and set earning limits, features that are not available with the Auto Pays tool.

- Auto Pays - This option applies the earning automatically in every batch (this includes multiple batches within the same pay period), regardless of whether other earnings are entered for the employee. However, unlike with Fringe Benefits, the Auto Pays tool can be used for both Earnings AND Deductions. It is also the only option that offers the ability to set an earning to apply to a specific Check Type when it is assigned to the batch.

Fringe Benefits

The Fringe Benefit tool is most often used to set up recurring earnings because if offers much more customization surrounding how the earning is applied to a check. To set up a earning using the Fringe Benefits tool, navigate to Benefits section of the Employee Profile and select Fringe Benefits.

Any earning that has already been set up will have options to Change or Edit the record, as well as Delete it altogether if needed. To add an earning, click the blue "+" sign in the top right corner. A window will then appear, prompting for the following fields to be entered:

- Earning Code - Select the appropriate Earning Code from the dropdown. All Earning Codes available from the dropdown are active Earning Codes that have been set up on the company-level.

- Amount - Establish whether the amount should be either a Flat-Dollar Amount ($) or Percentage (%), and then enter the amount in the field. For more advanced calculations that need to be applied toward the deduction amount, "Custom Calculations" can be created and applied. Be sure to consult with Empeon Customer Support if you feel a custom calculation is needed.

- Units & Rate - If the recurring earning should have designated hours (Units) recorded along with any applicable Rates or additional rates (Rate Codes), these fields can also be used to establish the amount for the recurring earning instead of entering an "Amount" in the previous field.

- Occurrence - Establish the frequency in which the deduction should applied toward the employee's paycheck. In most cases, recurring deductions are set up with a frequency of "OncePerPay" referring to the deduction being removed once per pay period. This way anytime there might be multiple checks within the same pay period, the deduction is only removed once. If a frequency preference is not available as a choice from the dropdown, please contact Empeon Customer Support for assistance.

- Payee - This is referring to Third-Party Agencies that can be designated as the recipient for the funds associated with the earning. While third-party agencies are typically used for deductions, they can also be set up for earnings when necessary. Third-party agencies must first be added at the company level for them to appear in the dropdown here. If no third-party agency applies to the earning, leave this field blank.

- Payee Reference - If a third-party agency is linked to the earning, a reference number may be applicable in order to identify where the funds are going.

The next section to consider when using the Fringe Benefit tool to set up a recurring earning is Fringe Limits. While there are no required fields in this section, the options here define any earning goals and limits that may be applicable to the Earning Code.

- Earning Goal - If the Earning Code has a capped amount to be paid over time, the total earning amount is entered here. As earnings are paid over time, the system will stop applying the earning once the "Goal" Amount is reached.

- Earned - If any contributions have already been made toward the Earning Goal, enter the total amount earned here. The system will subtract this amount from the Earning Goal and calculate future earnings based on the remaining balance until the goal is met.

- Minimum Per Check - For earnings calculated by percentage, this sets a minimum value that prevents the earning from being calculated below a specified amount.

- Maximum Per Check - For deductions calculated by percentage, this sets a cap to prevent the earning from exceeding a specified amount.

- Maximum Per Year - The value entered here sets a cap on the total amount to be earned over the course of a calendar year. Once the cap is reached, the earning will pause until the start of the new calendar year, at which point the earning will resume.

The final section when setting up a new recurring earning is Allocated To. Though not often used, this section offers the ability to allocate the earning toward a different Cost Center from what the employee is already assigned.

Once all fields have been appropriately attended to, click "Save" to finalize the deduction on the Employee Profile.

Auto Pays

The other tool available for additional recurring payment needs is the Auto Pays tool. Earnings set up as "Auto Pays" will be automatically applied in every batch, regardless of whether other earnings are entered for the employee. The Auto Pays tool is not limited to just earnings either; deductions can also be set up through this tool as well. However, the key difference with the Auto Pays tool is the ability to assign an earning to be applied only when a specific Check Type is assigned to the batch, making it ideal for when there are particular earnings (and deductions) that need to be applied toward bonus or commission batches.

To set up a earning using the Auto Pays tool, navigate to Payroll section of the Employee Profile and select Auto Pays.

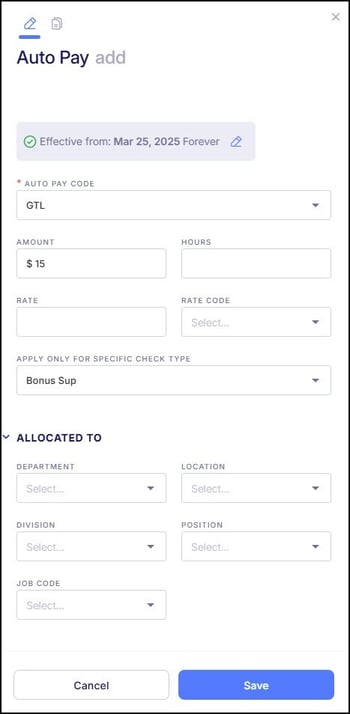

Any earning or deduction that has already been set up will have options to Change or Edit the record, as well as Delete it altogether if needed. To add an earning (or deduction), click the blue "+" sign in the top right corner. A window will then appear, prompting for the following fields to be entered:

- Auto Pay Code - Select the appropriate Earning or Deduction Code.

- Amount - Assign the amount to apply on every batch check.

- Units & Rate - If the recurring earning or deduction should have designated hours (Units) recorded along with any applicable Rates or additional rates (Rate Codes), these fields can also be used to establish the amount for the recurring earning instead of entering an "Amount" in the previous field.

- Apply Only For Specific Check Type - If the Auto Pay should only apply to one Check Type, use this field to identify it. Check Types are often custom per Empeon client with certain functionalities such as blocking deductions or setting special tax frequencies. If nothing is selected here, it will default to every batch.

The Auto Pays tool also offers the ability to allocate the earning or deduction being set up toward a different Cost Center from what the employee is already assigned. This is a feature that is consistent across both the Fringe Benefit tool and the Auto Pays tool.

Once all fields have been appropriately attended to, click "Save" to finalize the deduction on the Employee Profile.

For additional guidance on how to best go about setting up recurring earnings, please contact Empeon Customer Support.

For insights on how to set up Deduction Codes within the system and on a recurring schedule, please refer to the following articles: